Registration guide

This guide will walk you through the Raiz registration process. This helps to verify and secure your information and allows Raiz to recommend an appropriate portfolio for you. Bank-level standards of security help ensure that your information is protected.

After downloading the app, grab your online banking credentials. From there, it’s a simple, three-step signup process.

1. Link your credit or debit cards for round-ups

Raiz monitors your credit and debit card activity for round-up opportunities. Round-ups are like a digital version of spare change. Raiz can invest this spare change automatically, or you can approve the round-up of each card transaction manually. We recommend the default automatic round-ups setting to invest the change every time you spend.

Our current app allows certain banks (Commonwealth Bank, Westpac, NAB, ANZ, St. George, Bank of Queensland) to connect as Spending Accounts for round-ups and funding sources simultaneously by simply entering your bank login credentials. This is an easy one step process that allows you to start investing in minutes!

If you wish to connect one of these banks (Commonwealth Bank, Westpac, NAB, ANZ, St. George, Bank of Queensland) as a Spending Account to be monitored for round-ups:

Select your bank from the list for easy signup.

Link your credit or debit card by entering your online bank login credentials. Enter the same login credentials you would use to access your online banking website.*

Please Note: You may be required to confirm a security code or security questions in order to connect your bank account. The security code would be texted by your bank to the cell phone number associated with your bank account. Not all banks require this step.

Select all accounts that you would like to track for round-ups.

To Link a credit or debit card** issued by a bank not listed above, using your online banking login credentials:

Select your bank from the list for easy signup, or click “More” and search for your bank.

Enter the same login credentials you would use to access your online banking.*

If needed, answer one of your security questions for your bank account, or enter your bank PIN code. Not all banks require this.

Select all accounts that you would like to track for round-ups.

If you do not see your account provider on the list, please let us know by emailing support@raizinvest.com.au and sending us the bank’s information. If you are not interested in round-ups, you can skip this step. We won’t be able to collect round-ups for you, but you can still invest any amount at any time.

Additionally, there’s a feature that allows you to set up recurring deposits from your funding account to your Raiz account. If interested in the feature, go to “Deposit/Withdraw” from the Home page, select “Recurring” at the top, and enter the amount you’d like to be transferred from your funding account to your Raiz account on a daily, weekly, or monthly basis.

* These cards will not be used as the funding source.

** We use bank-level security to keep your information safe.

2. Connect a funding account

A funding source is a bank account which funds your Raiz account directly. Whenever the round-ups threshold ($5) is met or exceeded; lump sums are invested; or recurring deposits are established, this funding source is debited a corresponding dollar amount.

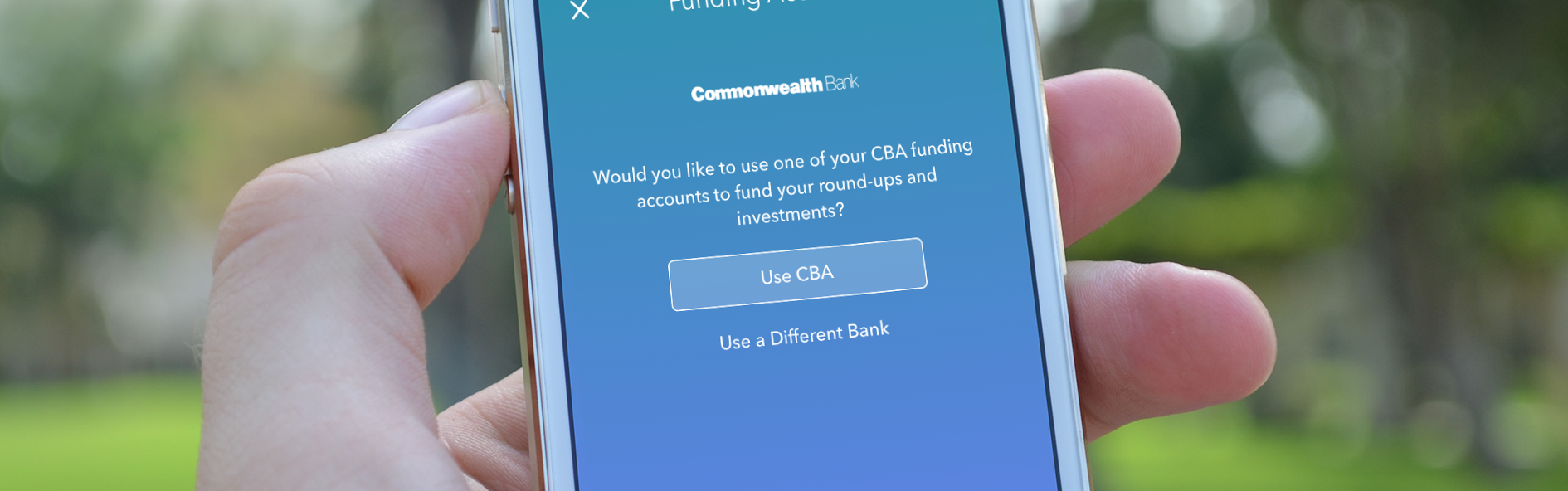

The latest app update features new ways to link your funding account. When you connected your round-ups account, you may have been able to establish your funding account with that bank as your funding source as well – all in one easy process. Select “Use (Your Bank Name)” if you would like to use your funding account from the same bank as the one you used for your round-ups.

If you would like to use a different bank, or one not on that list of 6 major banks, select “Use a Different Bank” and input your funding account and BSB numbers.

You can find your specific bank branch’s 6 digit BSB by logging into your online banking, by performing a quick Google search, or by looking at any bank statements.

Now your funding source should be set up successfully.

3. Tell us about yourself

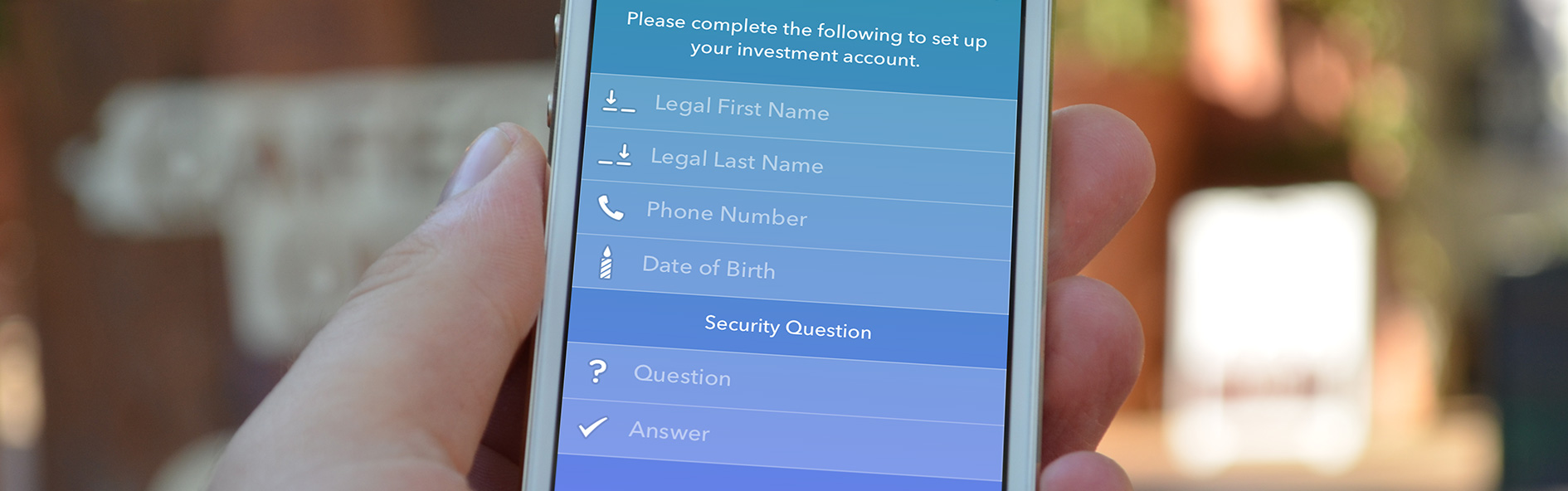

The final step in registration is to tell us about yourself. Raiz is required by law to collect and verify personal information related to your identity.

The first set of fields asks for your legal name, phone number, date of birth, and a security question. The following page will ask you to enter your permanent residential address. The next page asks you to confirm the following; Any information you enter into the app is true, accurate, current, and complete; that your funding account is not a credit card, overdraft amount or any other borrowed money; that you acknowledge that Raiz will undertake, in good faith, to generate and place the orders for ETF units, single stocks, RPF units and / or Bitcoin; that you have received and read the product disclosure statement.

The next set of fields covers your financial standing, including your employment status, net worth, income, investment goals, and time horizon. This information is part of the Raiz calculator which feeds into the next page.

Raiz encrypts and protects all customer data with bank-level security.

After you submit this information, Raiz will display an example Raiz portfolio. These portfolios range from conservative to aggressive, and correspond to different levels of risk and expected return. You can select a different portfolio at any time.

After choosing a portfolio, select “Confirm Portfolio” at the bottom of the screen. Next, you will choose your initial investment to start your Raiz account.

Net worth: The total value of all assets, including cash owned, real estate owned, and total value of investments, minus debts.

Income: How much you earn each year.

Investment goals: The item or lifestyle choice on which you plan to spend money accumulated from your investments.

Time horizon: The earliest time you may need to access a significant portion of your investment funds.

Troubleshooting your account

Sometimes issues arise when signing up for your Raiz account: perhaps information was not entered correctly or your bank login password changed. In these instances, a red triangle with an error message will appear on the home screen. Please tap this notification to address the problem. You can also visit the Settings > Accounts screen to manually update, link, or unlink round-up and funding accounts.

Please note: certain circumstances may require you to submit additional documentation in order to complete the account approval process. If you receive an error message which directs you to confirm your personal profile information, or to submit identity verification documents for review, this means that we were unable to verify your identity with the information provided. Please submit the required information and/or documents as requested, and we will approve your application as soon as possible.

If you need assistance, you may email us at support@raizinvest.com.au or call us at 1300 75 47 48